Donations

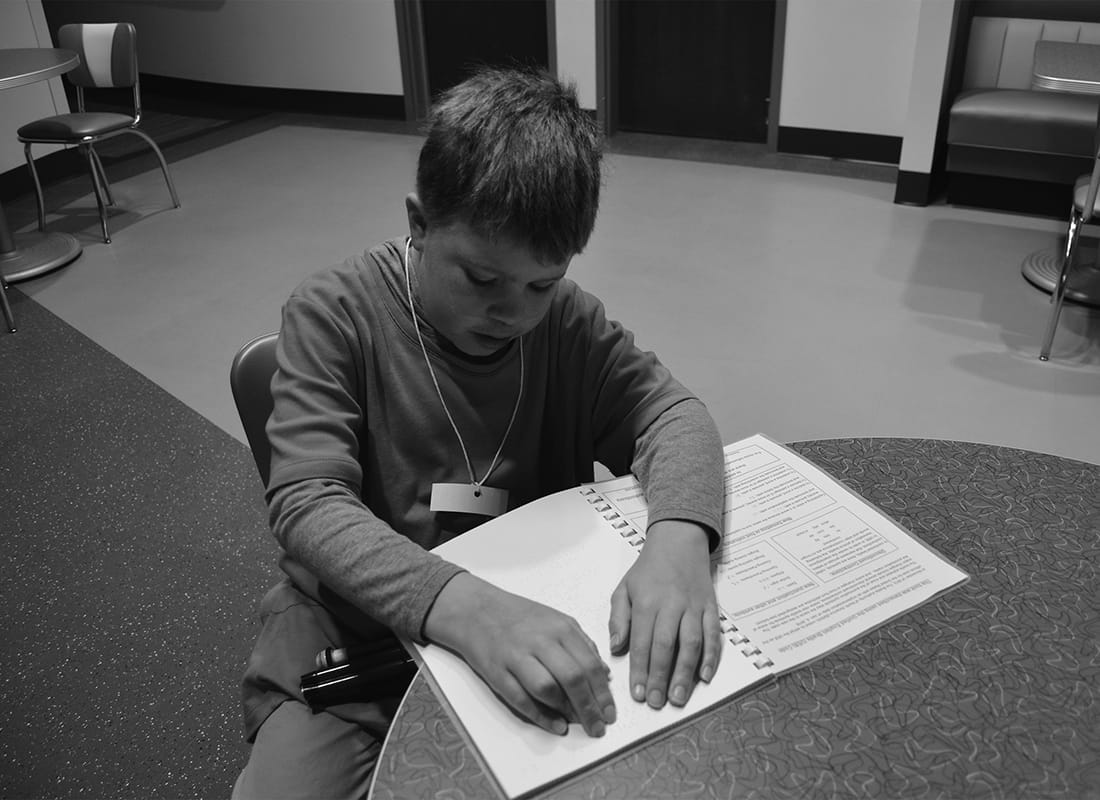

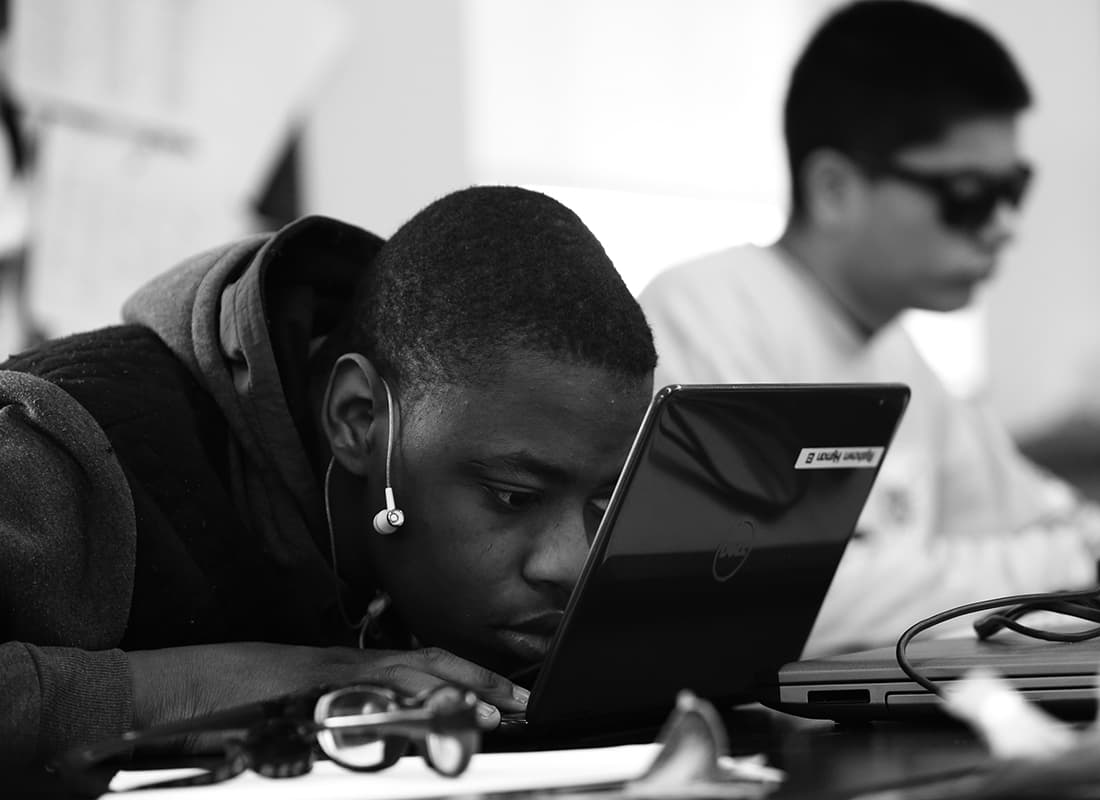

Your gift makes it possible for MSB to never charge tuition or fees for all of our programs including: 24 hour/5 day a week residential program, extracurricular activities, pre-k through high school classes, summer programming, competitive swim teams, wrestling, track and field, soccer, goal ball, beep baseball, and music and recreational therapies.

The Maryland School for the Blind welcomes contributions by check or credit cards through our secure online account.

For more information or to make a cash donation, contact Marlo Jacobson, Director of Development marloj@mdschblind.org

Donate NowDonate a Vehicle

Donate your car to the Maryland School for the Blind (MSB) and make a difference for blind and visually impaired students throughout all 24 Maryland jurisdictions. Your donated vehicle will include free towing at your convenience and is also tax deductible.

For more information on vehicle donation or to make a vehicle donation online click the button below.

Donate Now

Gifts That Cost Nothing During Your Lifetime

Did you know there are creative ways to support The Maryland School for the Blind? Ways in which The Maryland School for the Blind, you and your loved ones all benefit at the same time?

Such giving techniques are called “planned gifts,” because with thoughtful planning, you create win-win solutions for you and The Maryland School for the Blind.

For more information on how you can create a lasting legacy take a look at our Planned Giving pages.

Learn MoreMake a Gift of Stocks and Securities

Gifts of stock and securities may be made through the Development Office. Stock gifts receive tax credit based on the mean price per share on the date of transfer. To ensure prompt valuation and acknowledgement of your donation, please contact Marlo Jacobson, Development Director marloj@mdschblind.org

Contact Us

Give Through United Way

The Maryland School for the Blind is eligible for United Way funds, because our school is dedicated to the health, well-being, and education of children who are blind or visually impaired.

To make a designated gift through your United Way write in “The Maryland School for the Blind”